Who knew you could claim the sunscreen you slathered on during those open air functions last summer? Or the advanced barista course that made you the best coffee artist on the strip? We did – and that’s not all! Hospitality tax deductions put a big chunk of your hard earned cash back in your wallet […]

The Etax Blog: Tax Tips

Work at home parent – the ultimate balancing act

How do you build your business when you’re a work at home parent and your adorable darlings are doing their utmost to distract you with death defying leaps, or throwing tantrums that could literally wake the dead? The ultimate guide to finding a work/life balance for work at home parents OK, so you were never […]

Etax Fees: How much does a tax return cost at Etax.com.au?

Here’s everything you need to know about the low Etax fees and why Etax.com.au is Australia’s favourite online tax agent. Why is there a tax agent fee to use the online tax return at Etax? Etax is a registered Australian tax agent that offers you: Etax is like visiting an old-fashioned tax accountant – but quicker […]

When is the best time to do your tax return?

The best time to do your tax return is generally “sooner, not later”, but the reasons and details depend whether you have a refund coming, or you owe money to the ATO. PART ONE: What’s the best time to do your tax return… IF you expect a tax refund? If you will get a tax […]

Filling the pot: Tax deductions for chefs and cooks

Tax deductions for chefs and cooks really boost your tax refund – but do you know what you can claim on your tax return? Most of us have a love affair with food, so the fabulous people who create the dishes in our favourite cafes and restaurants become our absolute heroes. So what can we […]

Claiming Self Education Expenses as Tax Deductions

Self education is essential for our minds, our general sense of well-being and our future employment prospects Technology, software, and workplace processes change so fast, that if you don’t keep on top of it, you’ll quickly find yourself left behind in your career. Worse still, find yourself replaced by a more efficient, clued up, better […]

How do I do my tax return?

All your FAQs about tax! When you find yourself stepping into the world of ‘adulting’ it’s never long before you need to ask THAT question: ‘How do I do my tax return for the first time?’ More often than not, the jumble of answers you wade through makes you toss it in the ‘Too hard’ […]

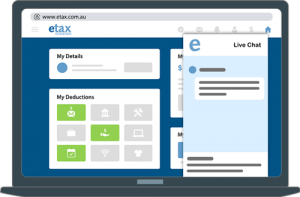

Etax Live Chat: Quick, online tax help at your fingertips

Get fast tax help today with Etax Live Chat! Did you know you get online tax help from an accountant while doing your tax return at Etax? It’s true. Our popular Live Chat service is staffed by qualified – and super friendly – accountants. These awesome tax whizzes are ready to help answer questions to […]

Game of Thrones + a Tax Return?

Etax users are posting about how they did their Etax return during a favourite show, during a lunch break… Are you eagerly waiting for the next episode of Game of Thrones to start? You could finish your tax return before the next battle scene. Last week one Etax client shared his experience using Etax.com.au for his […]

Don’t Be Afraid of the ATO at Tax Time

At the National Press Club, ATO commissioner Chris Jordan spoke about a change in tactics at the ATO, with a greater focus on work related deduction claims by individuals, representing $22 billion worth of claims made each year. He said a substantial portion of those claims are ‘mistakes’ or ‘fraud,’ although he did not discuss […]

Want to become a sole trader? 3 steps to make sure you do it right!

Do you want to become a sole trader with long term success? We have a few tips to help you get started! If you have a great idea or an original product? Do you have a clear idea about who your customers will be and what they want? Are you prepared to deliver knock out service? If you answered […]

Being made redundant could re-ignite your career: Redundancy tips from a careers expert

Being made redundant is often a tough thing to overcome. Yet, an amazing two per cent of Australian workers experience it every year! We spoke to Australian career advice expert Russell Johnson, a career planning veteran with CEO-level experience in Australia and the US, to get a fresh perspective on being made redundant. Russell also […]

Holiday Rental Tax Deductions: The Basics

Do you own a holiday rental property? You could be eligible for valuable holiday rental tax deductions. Holiday rental properties are a common type of investment property in Australia. Although the operating costs of a holiday rental property can be higher than other rentals, rents are higher too. So, when well managed and maintained, the […]

How To Claim The Car Logbook Method (Free Car Logbook Template)

The car logbook method is a good way to track your car expenses and claim them on your tax return (to increase your tax refund). But, you need to keep a car logbook. If you use your car for work purposes, the ATO will let you make a claim on your tax return for some car-related […]

How to Save Tax in Australia: Three Easy Ways to Get a Bigger Tax Refund

When you do your tax return each year, do you get the full tax refund you’re entitled to? Are you looking for a bigger tax refund, but don’t know where to start and don’t want to get in trouble with the ATO? In Australia, millions of people miss legitimate tax deductions. That means people don’t […]