A new $1000 Instant Tax Deduction is coming next year. Here’s the short version: In the lead-up to the April 2025 federal election, the Government announced a “$1000 instant tax deduction”. They label this as “Tax reform for easier, faster, better tax returns”. They claim it will provide cost-of-living relief and make it easier and […]

Stage 3 Tax Cuts explained – what do they mean for you?

Stage 3 Tax Cuts in a snapshot Stage 3 tax cuts were adjusted from 1 July 2024, aiming to give a bit of a tax break to lower and middle income earners, compared to earlier tax changes that favoured workers already enjoying the biggest salaries. Compared to the original tax cuts, the new changes help […]

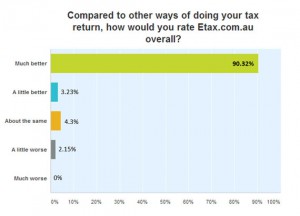

myGov vs Etax vs tax agent office

“What’s the best way to do my tax return?” Let’s compare myGov, Etax and other tax return options: What’s the best one for you? The ATO advertises a tax system called myTax, which is inside the myGov website – and it’s one way to lodge your tax return. As a taxpayer, it is hard for […]

Australian Tax Deadline – October 31

The tax deadline for lodging Individual Tax Returns each year is October 31st Beating the tax return deadline takes just a few minutes, with live online support to make it easy. Get Started NowReturning Users Login To lodge your 2025 tax return now, follow these easy steps: What happens next? After you sign your return, […]

Claiming Home Office Expenses

The ATO changed how you claim home office expenses moving forward Before we get into the details, don’t stress – at Etax we’ll help get it right for you. Some of the changes to work-from-home claims are complicated, but, Etax will automatically calculate which deduction method gives you the biggest refund, so you don’t have […]

ATO Data Matching – What is it and will it affect me?

You may have heard that ATO data matching technology is now being used in Australia. The ATO launched the system to find missing income from individual tax returns. It’s a new, more sophisticated way to collect more tax from taxpayers who may, either accidentally or deliberately, understate their income. What is ATO Data Matching? ATO […]

Investment property tax deductions under the ATO spotlight

Australian investment property owners may be on a collision-course with the Australian Tax Office (ATO) in 2025, over incorrect claiming of tax deductions. Along with the rising cost of living and borrowing rates in Australia, the estimated 1.7 million people who own a rental property will also have their investment property tax deductions put under […]

Tax Bracket Creep in Australia: What Is Bracket Creep, And How Does It Affect You?

Bracket creep is a situation in Australia where inflation and wage increases push more and more people into higher tax brackets. The result is that income tax takes more and more of people’s earnings, even though the Government did not formally raise tax rates. Let’s dig into the concept of bracket creep, its impact on […]

The First Home Super Saver Scheme (FHSSS): your guide to buying your first home sooner

If you’re someone who’s been saving for a first home deposit, then there’s one scheme you should know about. It’s called the First Home Super Saver Scheme (FHSSS). The point of the scheme is to help people of all ages get into their first homes sooner. It was introduced by the Australian Government in the […]

Can’t work due to COVID? What help is available?

What do you do if you can’t work due to COVID? With self-isolation rules relaxing, the Government is no longer providing the Pandemic Leave Disaster Payment. Instead, the High-Risk-Setting Pandemic Payment has taken its place but is not available to everyone. Luckily there is some help out there to help you stay afloat if you […]

Government Tax Cuts Extended

The 2022 Budget threw in a few perks for businesses but the one that around 10 million taxpayers will appreciate, is the decision to increase the tax offset for low and middle income earners. The Low and Middle Income Tax Offset, often referred to as the LMITO, has been increased for the 2021-2022 income year […]

How to Claim Personal Super Contributions Tax

Invest in your future by adding money to your superannuation AND score some savings at tax time. Sounds great, right? Let’s cover how to claim your personal super contribution tax on your next return. Most Australians know that super is money for retirement. What’s less well known is: What is Super Contributions Tax? A personal […]

ATO crackdown on ride sharing drivers

Concerned that too many drivers are avoiding tax, the ATO is cracking down on ride sharing drivers contracted to companies such as Uber, Ola and Didi Last year the ATO warned Uber drivers that avoiding tax wasn’t an option, this year it’s getting evening tougher. Banks are required to provide details of ALL customer payments […]

Tax Cuts Announced for 2020-21

Federal Government brings forward tax cuts for the 2020-21 financial year To stimulate a struggling Australian economy, the Australian Federal Government has brought forward Stage 2 of their planned tax cuts and back dated them to 01 July 2020. The cuts originally penned to come into effect July 2022, will now take place in the […]

The Medicare Levy

What is the Medicare Levy? Have you ever looked at your Notice of Assessment (NOA) or tax refund estimate and seen a line for the Medicare Levy? Not sure what it is? Don’t worry, you’re not alone and this article has got you covered. For most Australians, healthcare is essentially free. If you get sick, […]