When you’re expecting a tax refund, waiting is never easy. Instead of just wishing it will arrive sooner, read on! There’s no way to know exactly how long the ATO will take to process your tax return. Behind the scenes, the ATO examines tax returns more closely than ever, analysing and comparing your return to […]

Tax Advice

Tax Advice: 2024 Tax Return | Increase Your Tax Refund | Tax Deductions | Medicare and Health Insurance | Tax Rebates

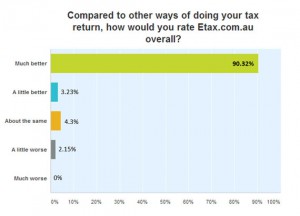

myGov vs Etax vs tax agent office

“What’s the best way to do my tax return?” Let’s compare myGov, Etax and other tax return options: What’s the best one for you? The ATO advertises a tax system called myTax, which is inside the myGov website – and it’s one way to lodge your tax return. As a taxpayer, it is hard for […]

How To Do Your Best Tax Return and Boost Your Refund

Many Australians lose hundreds of dollars each year – simply because they forget about work-related deductions and the receipts for items they can claim. Do you compare your tax refund to your friends and family and wonder, “How can I get a better refund”? There are many ways Australians can improve their tax refund. Unfortunately, […]

APRA Super-fund or a Self-Managed Super Fund?

Choosing the Right Super Option for Your Unique Needs Self-managed super funds (SMSFs) are growing in popularity and more Australians are using them to build their retirement funds. What are SMSFs, and most importantly, are they worth it? Below we compare the two most popular options, self-managed and APRA-regulated funds. Definitions What is a Self-Managed […]

Claiming Work From Home Tax Deductions

If you’re an employee who works from home, you’re probably using things like your phone, internet, and electricity. These are considered work from home tax deductions that you could potentially claim on your tax return.

Work related car expenses: what can I claim on my tax return?

The ATO has rules for how to calculate car deductions. Find out how new car deduction rules may affect you (and your tax refund).

Simple Ways to Improve Your Tax Refund

Here’s the most common question people ask us every year: How can I get a bigger refund and pay less tax?” Australians are always looking for ways to improve their tax refund. We’ll answer this common question with four easy ways to improve your refund… 1. Manage your tax receipts Keeping track of your receipts […]

A Simple Guide To Tax Deductions in Australia

A tax deduction is something you paid for, out of your own pocket, that can be listed on your tax return. Deductions can help reduce your taxable income, which boosts your tax refund at tax time.

A Simple Guide to Understanding Depreciation

How does depreciation work on your tax return Just the idea of depreciation seems complicated, but understanding it is crucial for those who own rental properties, run a small business or those who want to claim a tax deduction for work-related purchases over $300. For this reason, we’ve put together a very simple guide to […]

Why Is My Tax Refund So Low?

And How Do I Avoid It Happening Again?

Approximately eight out of every ten Australians who lodge a tax return receive a tax refund. But for some of us, the refund that we get isn’t quite as big as we expect.

“Instant Tax Refunds” – Read This Before You Sign

At tax time you often see ads for a “same day tax refund” or “instant tax refund”. It might sound appealing to get your tax refund today… But the truth is, a “same day tax refund” is not really what the name suggests. Can I Get my Tax Refund Today? Most Australians wait only 6-10 […]

Claiming Home Office Expenses in 2024

The ATO announced big changes to how you claim home office expenses on your 2024 tax return. Before we get into the details, don’t stress – at Etax we’ll help get it right for you. Some of the changes to work-from-home claims are complicated, BUT, Etax will automatically calculate which deduction method gives you the […]

What is the maximum ATO late lodgement penalty?

The maximum fine handed out by the Australian Taxation Office (ATO) for not lodging your tax return by the 31 October deadline is $1,650! Fines can start at $330 for being just one day overdue, then increase over time, as follows: Days overdue Total fine amount 1 – 28 days $330 29 – 56 days […]

Changes to the Stage 3 Tax Cuts explained

Stage 3 Tax Cuts in a snapshot The government’s tax changes to the stage 3 tax cuts came into effect from 1 July 2024. Compared to the original stage 3 tax cuts, these changes give a break to low and middle-income earners by lowering the tax withheld from their take home pay. The result: Australians […]

What is negative gearing and is it the right strategy for you?

Put simply, negative gearing occurs when an investor borrows money to buy a property, and the cost of owning and running that property exceeds the rental income it generates. As an investor of a negatively geared property, you make up the gap between the expenses on the property and the rental income. This isn’t always […]